Have health insurance companies complied with the new price transparency requirements? And does it help patients? We reviewed websites for BCBS, Cigna, and United.

Beginning January 1, 2023, health insurance payers were required to have an online price comparison tool that allows consumers to obtain a cost estimate for specific items and services. This new requirement was included as part of the No Surprises Act, which was designed to protect consumers from surprise medical bills and make health care costs more transparent. Insurers are currently required to provide cost estimates for only 500 items and services but will need to provide cost estimates for all items and services starting in 2024.

We wanted to see how insurers were complying with this new requirement. So we searched the online comparison tools of three of the largest insurers—BCBS, Cigna, and UnitedHealthcare—to see if we could obtain cost estimates for a routine colonoscopy (CPT code 44388). We purposefully searched the same CPT code across all three insurers to make an apples-to-apples comparison. Here are the key takeaways from our research.

Takeaway #1 – Some payers comply but there are issues

For example, BCBS displays rates by provider and place of service, while United displays an average only. United Healthcare includes additional cost-sharing information and ties facility costs to procedure costs, while others display per-unit professional rates only.

Below are some examples from plan network websites. Note: This information has been updated as of Feb-March, 2023. Payers may have changed their websites since we accessed the information.

Blue Cross Blue Shield

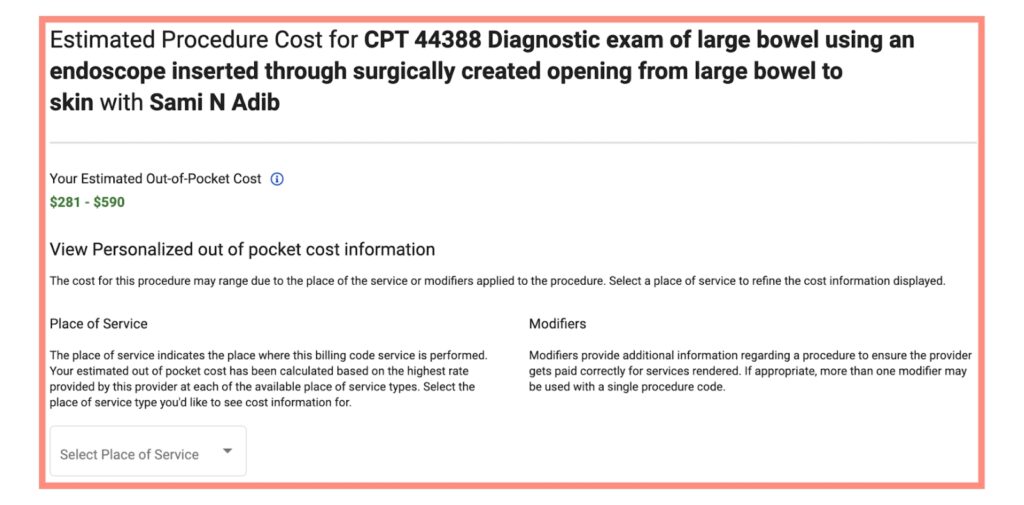

When searching for the cost of a specific service, BCBS initially presents the consumer’s out-of-pocket costs as a range. For example, as seen in the below screenshot, the cost of a colonoscopy from one provider ranges from $281 to $590.

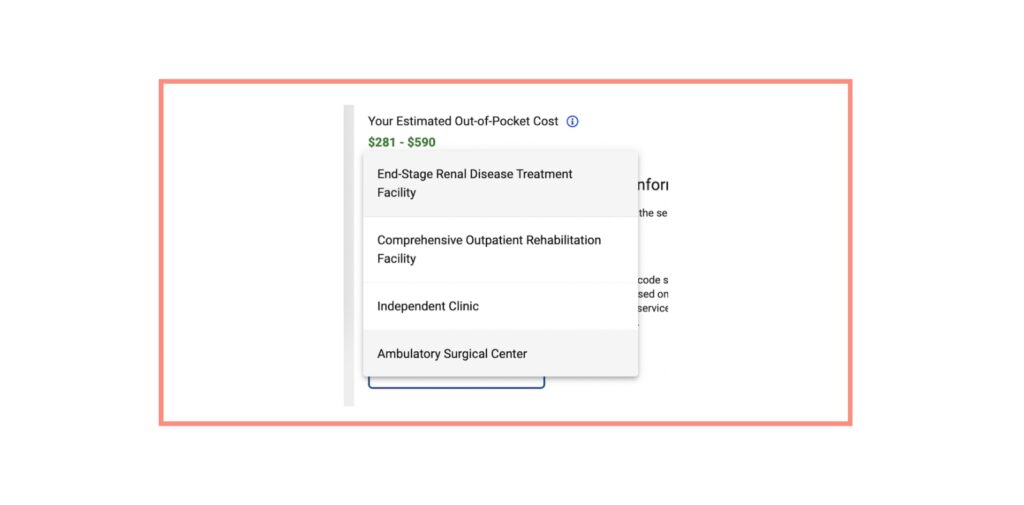

The estimated cost is initially presented as a range because the exact amount depends on which type of facility will perform the service. BCBS provides the consumer a drop-down menu to select between various facilities where the service might be performed.

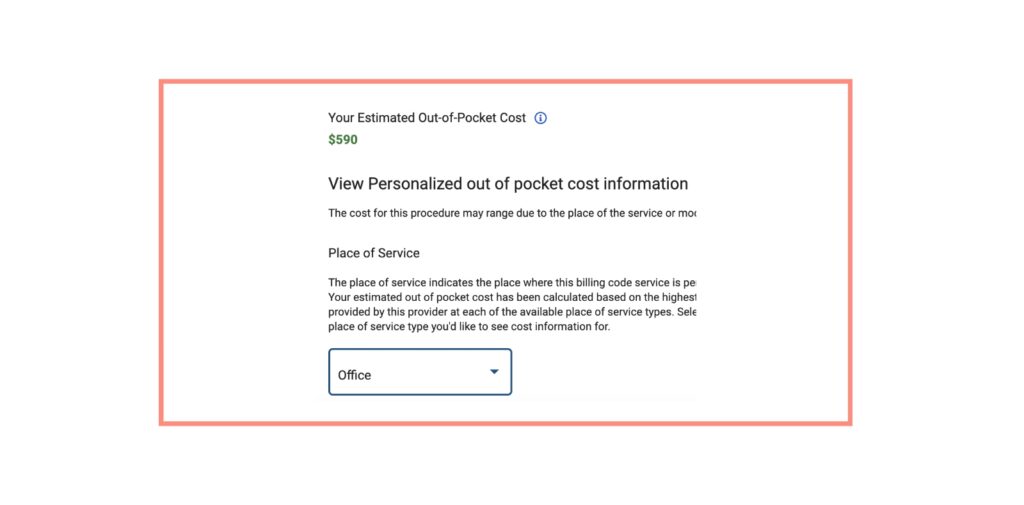

We selected an office as our place of service, which resulted in an estimated cost of the high-end range—$590.

Notably, when we looked at the estimated cost of a colonoscopy from other providers, we found that these estimated costs sometimes differed from the estimated cost in our above example. BCBS’s online price comparison tool does what we expect it to do: It allows consumers to search for the cost of a specific service and compare providers based on their cost of providing that service.

Cigna

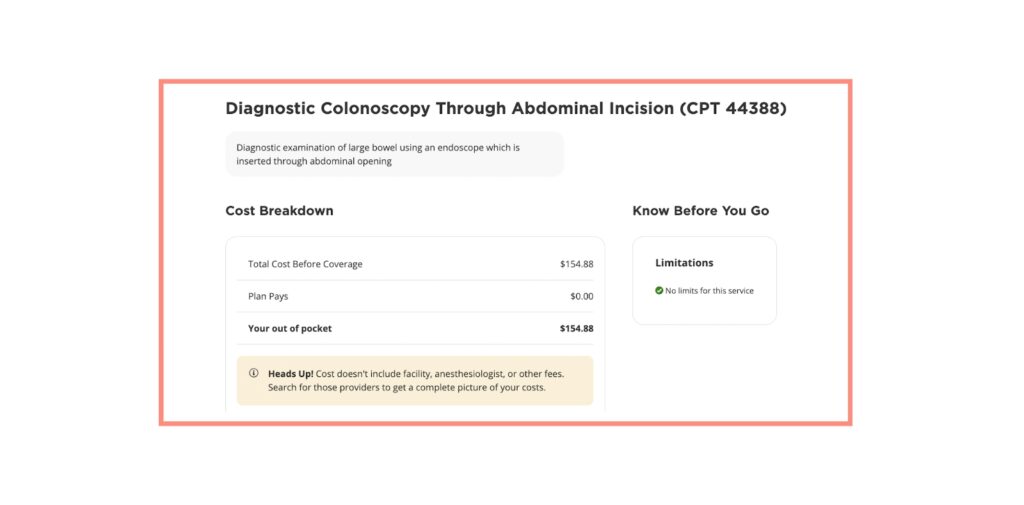

Cigna has a more streamlined process as compared to BCBS. Unlike BCBS, Cigna did not provide a cost range and required us to select a place of service before disclosing the cost estimate. Instead, when we searched for a colonoscopy, we were immediately shown one provider’s estimated cost.

When we searched for the cost of a colonoscopy from other providers, we found that the estimated cost differed among providers. Cigna, like BCBS, is complying with the requirement to disclose estimated costs specific to providers.

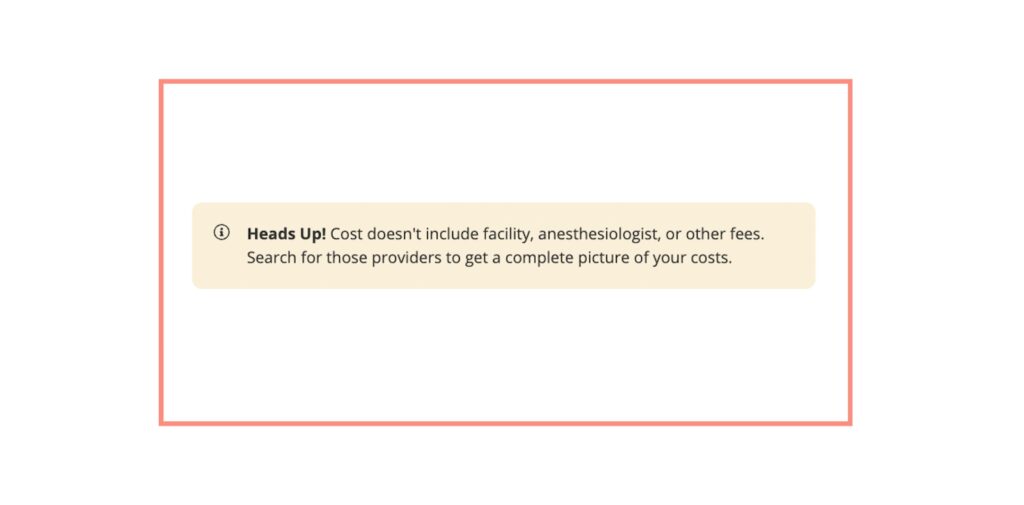

Notably, each cost estimate we reviewed included the following disclaimer:

This disclaimer serves as a warning to consumers that Cigna’s cost estimate may not include all of the fees that the consumer may be charged for a service. It appears that Cigna is including this disclaimer to protect itself from consumer complaints that the cost estimates are inaccurate and misrepresent the true cost of a service. But this disclaimer is not particularly helpful to consumers.

The disclaimer vaguely states that the estimated cost does not include “other fees” and that consumers should “[s]earch for those providers” to get an accurate cost estimate. Yet most consumers will not know what “other fees” will be charged for a particular service or which additional providers will be involved with providing the service. As a result, consumers may understandably be frustrated with this disclaimer; Cigna is warning consumers that the cost estimate may be inaccurate because it does not include certain fees but does not instruct consumers on how to identify those fees.

UnitedHealthcare

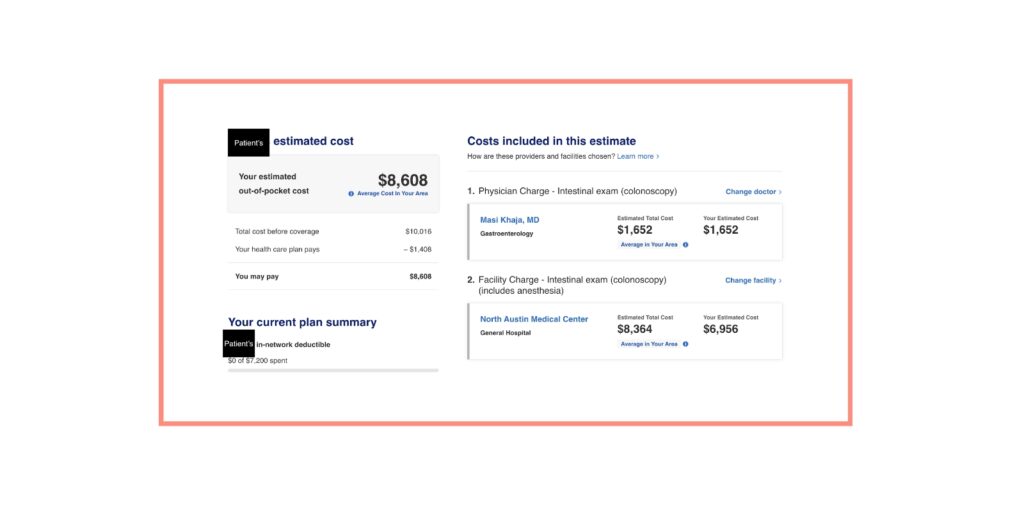

Unlike BCBS and Cigna, which disclose how much a particular provider charges for a service, UnitedHealthcare does not appear to be providing this information. When we searched for a colonoscopy, the screenshot below showed the consumer’s total estimated cost broken down by physician and facility. However, below each estimated cost was a disclaimer link titled either “Average Cost in Your Area” or “Average in Your Area.”

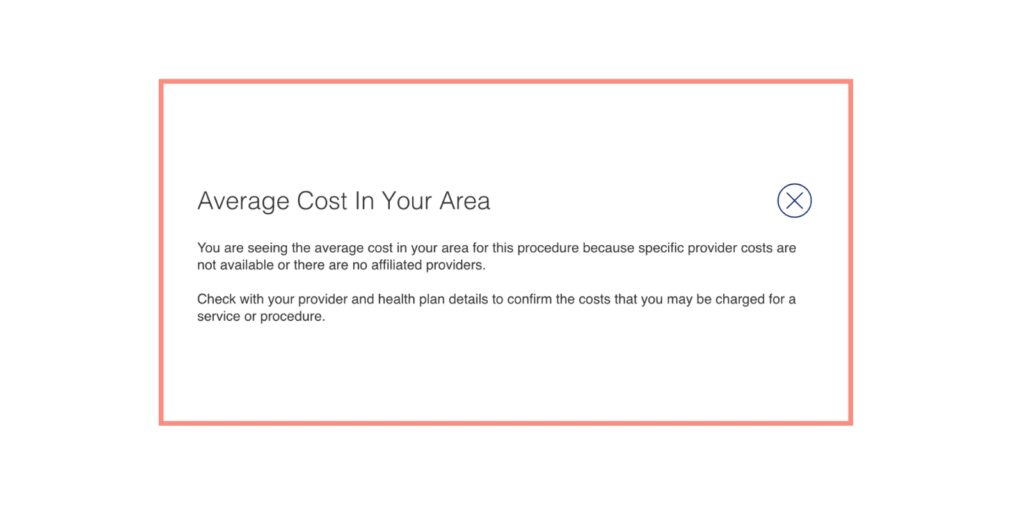

When we clicked on these links, a pop-up box appeared saying that the specific provider costs were unavailable and that the displayed cost represented the average cost in the consumer’s area.

This disclaimer is concerning because insurers must provide cost estimates specific to providers—not merely an average of all providers in a certain area. But even more troubling is that this disclaimer was not limited to only one service or provider. We reviewed other services and providers and found that UnitedHealthcare attached this average-cost disclaimer to each service and each provider we reviewed.

Providing only average costs is problematic for two reasons. First, the consumer is unable to compare providers by cost. Because each provider is shown to be charging the same average cost for a service, the providers are indistinguishable from a price perspective.

Second, the consumer must learn how much a particular provider will charge for a service. Although the consumer may know the average service cost, the consumer will only find out if a provider charges more or less than that average once the consumer receives the bill.

Based on our review, UnitedHealthcare does not comply with the requirement to disclose how much its providers charge for services. By providing only the average service cost, UnitedHealthcare consumers cannot shop for providers based on price and remain in the dark about how much a provider will charge. These are the exact problems that online price comparison tools are supposed to fix. Due to this lack of price transparency, UnitedHealthcare consumers are significantly disadvantaged compared to BCBS and Cigna consumers in making informed healthcare decisions.

Takeaway #2 – Consumers will likely be confused

The health plan price transparency data provides much more accurate cost information than the insurers’ online price comparison tools. Understanding healthcare costs requires a baseline understanding of how services are billed, typically using a CPT code and multiple provider identifiers. For some procedures, there are both facility and practitioner costs. Consumers will have a hard time understanding these rates without this knowledge.

The insurers’ online price comparison tools could prove very useful for consumers—if consumers understand how to navigate the comparison tools and interpret the cost information. But there are several ways in which consumers might be confused or frustrated by these comparison tools.

- Consumers must know what CPT code to select when searching for a service. Due to our healthcare system’s complexity, many billing codes appear when searching for simple procedures, such as colonoscopies. Consumers understandably might need to know which one to select and, if they choose the wrong one, will receive an irrelevant cost estimate.

- In the case of BCBS consumers, they must select a place of service to receive a specific cost estimate instead of a cost range. But most consumers need to find out where the service will be performed, leaving them to guess. If they choose the right place of service, their cost estimate will be accurate.

- Cigna consumers are informed that the cost estimate may underestimate the true cost of service because the cost estimate only includes some of the potential fees. But Cigna needs to provide consumers with guidance as to how they can identify those additional fees. If consumers need help figuring out those additional fees on their own, they may question the accuracy and reliability of the cost estimate.

- UnitedHealthcare consumers are only provided the average cost for a service in an area, not an estimated cost specific to a provider. But UnitedHealthcare’s disclaimer on this issue is not conspicuous. The link that discloses this information is written in small font, and the consumer must take the initiative to click and read the link to learn that the cost estimates are only averages. If the consumer does not see or read the link—and many consumers will not—then the consumer will be misled as to what the cost estimates represent.

Takeaway #3 – New public data has more information than plan websites

The health plan price transparency data published in machine-readable files provides much more specific cost information than the insurers’ online price comparison tools.

The insurers’ online price comparison tools are unquestionably a step in the right direction in improving price transparency for consumers. Consumers now have access to cost information that was previously unavailable to them. This information may be incredibly useful to consumers when deciding whether to undergo a service and, if so, which provider they should choose. Simply put, it is now easier for consumers to make more informed decisions about their health care.

The information provided by these online price comparison tools needs to be more accurate. The online price comparison tools only disclose a provider’s estimated costs for performing a service, not the provider’s actual costs. And while consumers will likely find it useful to know the estimated cost of a service, it is more helpful to know the actual cost.

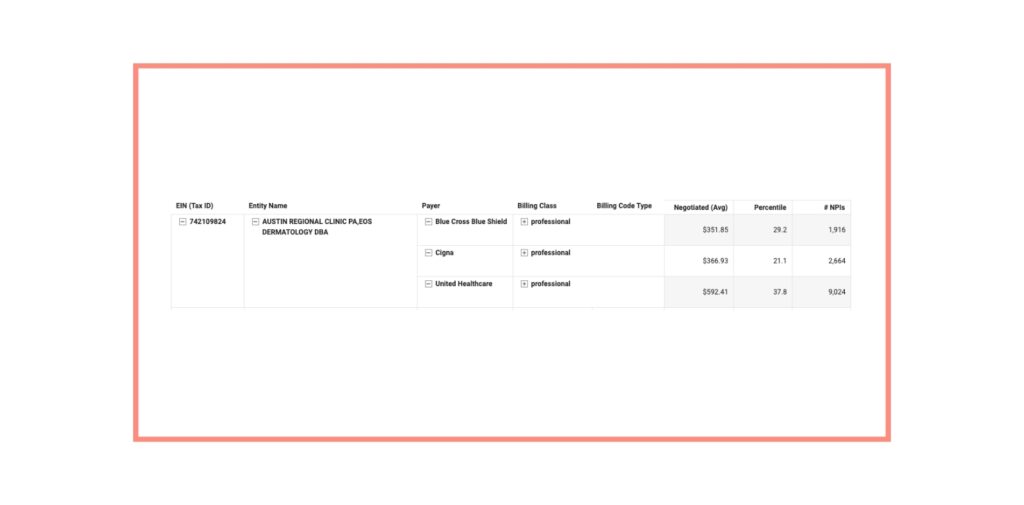

Fortunately, actual costs can now be found in the health plan price transparency data. The transparency data was first released in July 2022 and included machine-readable files of the prices that insurers negotiated with participating providers for covered items and services. But the transparency data could be more voluminous, messy, and complicated to analyze, making it inaccessible to the general public.

Keywell has developed PriceLink – a tool to analyze price transparency data and market reports. Using the transparency data, Keywell can ascertain the actual costs that providers charge for services and provide price information that is much more accurate than the estimated costs found in the insurers’ online price comparison tools.

For example, for the same procedure (Colonoscopy code 44388) for a specific provider in Austin, TX with NPI 1467424267, Keywell PriceLink uncovers this breakdown for the individual provider rates. Unlike some payer websites, the data is specific to the NPI as well as the parent organization (Austin Regional Clinic) that negotiates rates with payers.

Contact us at info@keywell.ai to see a PriceLink demo and learn how it can benefit your organization.